A 401k plan is a retirement savings plan sponsored by an employer. It allows employees to save and invest a portion of their income before taxes are taken out. This can be a valuable benefit for employees, as it can help them save for retirement and potentially lower their tax bill.

One of the main benefits of a company sponsored 401k is that it allows employees to save for retirement on a tax-deferred basis. This means that the money they contribute to the plan is not subject to income tax until they withdraw it. This can be a significant advantage, as it allows employees to save more money for retirement and potentially pay less in taxes.

Another benefit of a company sponsored 401k is that it can be a convenient way for employees to save for retirement. Many plans offer automatic enrollment and automatic contribution increases, which makes it easy for employees to start saving and to increase their savings over time.

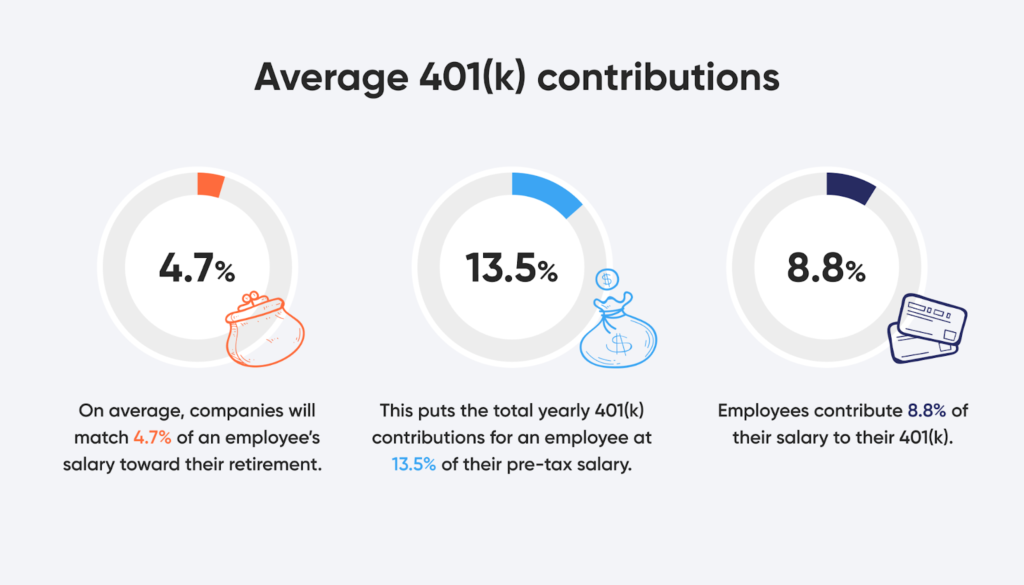

Many companies also offer matching contributions to their 401k plans. This means that the employer will match a portion of the employee’s contribution, effectively increasing the employee’s savings. This can be a great incentive for employees to save more for their retirement.

Additionally, 401k plans often offer a variety of investment options for employees. This allows them to choose the investment options that best align with their risk tolerance and investment goals.

While a 401k plan can be a valuable benefit for employees, it is important to note that it is not a substitute for a comprehensive retirement savings plan. Employees should also consider other savings options, such as individual retirement accounts (IRAs) and savings outside of retirement accounts.

Overall, a company sponsored 401k can be a valuable benefit for employees, as it allows them to save for retirement on a tax-deferred basis, provides a convenient way to save, offers matching contributions and a variety of investment options. It is important for employees to take advantage of this benefit and to also consider other savings options to have a comprehensive retirement savings plan.